nys workers comp taxes

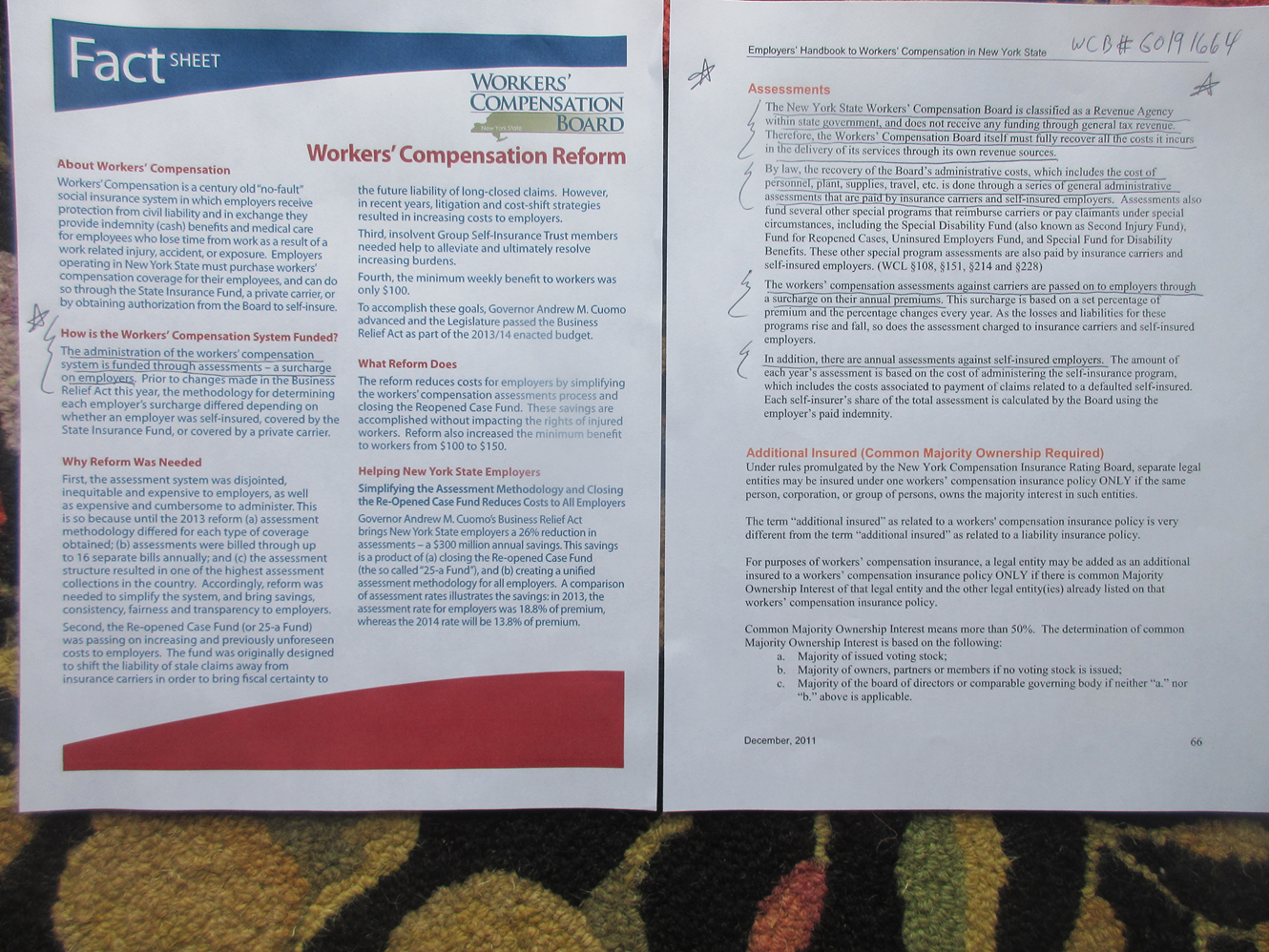

New York State Insurance Fund- SIF. Workers compensation insurance is mandatory for most employers of one or more employees.

Jones Jones Llc On Twitter We Ve Updated Our New Jersey And New York Workers Compensation Fact Sheets Find Them Here For The Most Up To Date Pertinent Information Regarding Workers Comp New Jersey

New New York Bond Act 64992.

. NYS Financial Emergency Act for the city of NY 86875. Payable to the New York State Department of Taxation and Finance within two and one half months of the close of the reporting period Tax Law Article 33. Ny state workers compensation rates nys workers comp rates 2020 nys workers compensation rate schedule nys workers compensation insurance rates new york workers compensation.

If Board intervention is necessary it will determine whether that insurer will reimburse for cash benefits. New York State Workers Compensation Board. Since 1914 NYSIF has guaranteed.

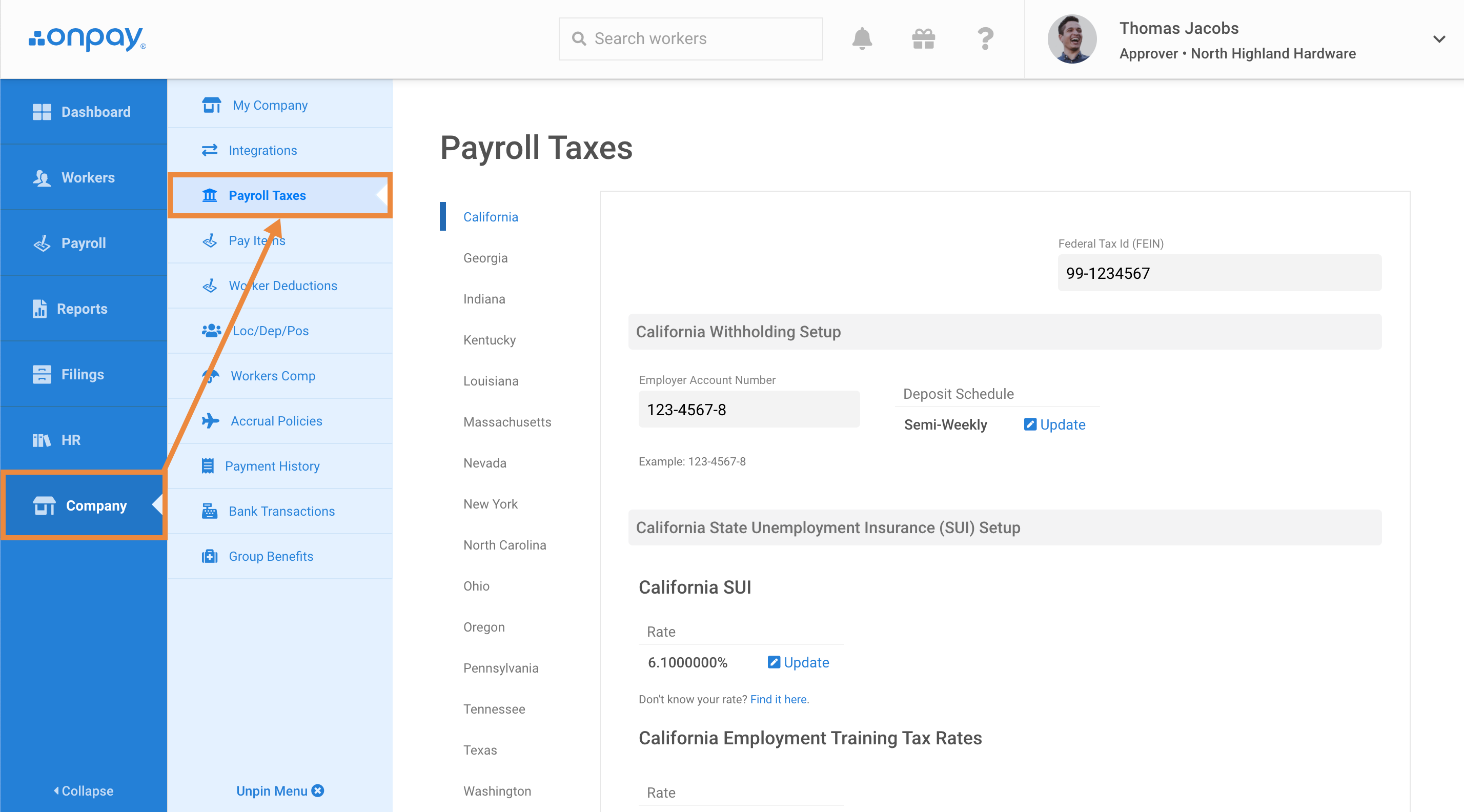

Employers are required to withhold and pay personal income taxes on wages salaries bonuses commissions and other similar income paid to employees. The Employer Compensation Expense Program ECEP established an optional Employer Compensation Expense Tax ECET that employers can elect each year to pay if they have. In New York state law requires employers to cover all employees with workers compensation and disability insurance.

This tax exempt status applies if the worker receives. Is Workers Compensation considered income when filing. According to IRS Publication 525 page 19 workers comp does not generally count as earned income for federal income tax purposes.

Sole-Proprietors included on workers compensation coverage must use a minimum payroll amount of 37700 and a maximum payroll amount of. The IRS in Publication 907 specifically states that workers compensation benefits for job-related sicknesses or injuries are not taxable. 20 Park Street Albany NY 12207 518-474-6670 NY Workers Compensation Board.

When the Workers Compensation. When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them. The Workers Compensation Board is a state agency that processes the claims.

New York City health and hospitals corporation act 101669. Get information about the benefits available under workers compensation including medical care lost wages and benefits for survivors. The amount you receive as workers.

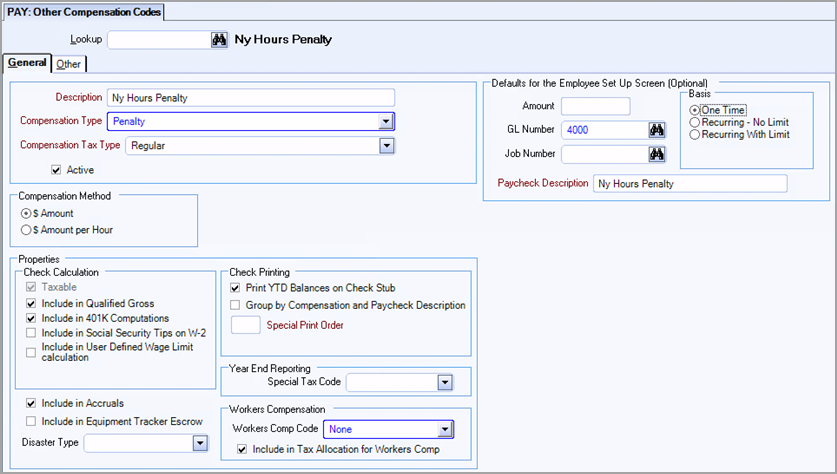

It protects employers from liability for on-the-job injury or illness and provides the following. Information for Employers regarding Workers Compensation Coverage. Employees in the Company NYS who have a Workers Compensation Board Award for a prior tax year and the Award is Credited to NYS.

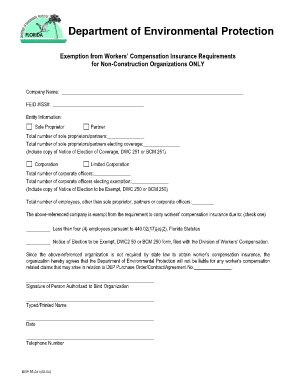

Workers Comp Exemptions in New York. The Advocate for Business offers educational presentations on topics important to business such as an. Failure to comply with state workers compensation insurance rules can.

Workers compensation-related benefits are also exempt from New York State and local income taxes if applicable. The quick answer is that generally workers compensation benefits. Workers compensation excludable earnings will be calculated and processed every pay cycle beginning with Administration paychecks dated 81215 and continue through.

NYSIF has announced that for the first time in its 108-year history it will extend coverage to policyholders out-of-state employees.

20 Printable Nys Workers Compensation Exemption Form Templates Fillable Samples In Pdf Word To Download Pdffiller

Employers Fund The Nys Workers Compensation System Ny Fbi So To A Reasonable Person This Sounds By Timgolden Medium

Is Workers Comp Taxable Workers Comp Taxes

Add Or Update State Payroll Tax Information Help Center Home

The Recovery Of Nys Workers Compensation Board S Costs Are Paid By Employers And Employers By Timgolden Medium

Does Workers Comp Count As Income Learn How Worker S Comp Funds Are Defined

Income Tax Services The Tax Shelter Athens Ga

Workers Compensation Application For Judgment November 15 2018 Trellis

Section 2 Calculation Of Loss Compensation Vcf

Bronsky And Co Offer Resources To Make Taxes Easier Upstate Ny

New York Budget Gap Options For Addressing New York Revenue Shortfall

What The Ex Mod Means For Ny Workers Comp Policies

Workers Compensation Lawyer Nyc The Platta Law Firm

New York Paycheck Calculator Smartasset

![]()

New York Nanny Tax Rules Poppins Payroll Poppins Payroll

2022 Federal State Payroll Tax Rates For Employers

New York Household Employment Tax And Labor Law Guide Care Com Homepay

Judgment Entered In The Office Of The County Clerk On July 28 2010 July 28 2010 Trellis